The economic scientists were forewarned some time ago by Joseph Stiglitz, Stanford University’s Nobel laureate economist. Writing to The Guardian, he opined: “The standard measure of economic performance is gross domestic product (GDP), which is the sum of the value of goods and services produced within a country over a given period. GDP was humming along nicely, rising year after year, until the 2008 global financial crisis hit. The global financial crisis was the ultimate illustration of the deficiencies in commonly used metrics. None of those metrics gave policymakers or markets adequate warning that something was amiss. Though a few astute economists had sounded the alarm, the standard measures seemed to suggest everything was fine”.

Even prior to Stiglitz, some leading economists argued the rate of growth in itself is not a metric indicating that the process of economic development is on its way. According to them, if there is no noticeable tendency to reduce unemployment, poverty and inequality in the country, the increase in rate growth may not necessarily treated as a reflection of the fact that the country is on the path of economic development.

Stiglitz added three more variables that are pertinent in portraying the economic picture of a country. They are the problem of inequality, the problem of ecology and the problem of democracy.

However, what I intend to argue in this article is somewhat different. One may say my argument is coming from and linked with the arguments for de-growth as advanced by environmental economists and activists. However, I feel my argument goes beyond that and is dependent on different kind of reasoning. So far, the economists have generally assumed that the issues of inequality, poverty, unemployment may be addresses as a by-product of economic growth. More right-wing genre of economists have even believed that if proper monetary values are given, the market may also resolve the problems listed by Stiglitz.

Growth Performance in Sri Lanka

Sri Lanka has so far experienced a negative economic growth only once in the last forty-two years when the LTTE attacked the Bandaranaike International Airport incurring heavy damages. Although Sri Lanka has recorded an average GDP growth rate of 4.2 per cent in the last 72 years since independence, this achievement (if we describe it so) has been associated with three deficits of critical importance, namely, trade deficit, fiscal deficit and savings deficit. As a necessary corollary of continuous presence of these deficits, Sri Lanka’s foreign debt servicing (both private and Government) has surpassed 6.5 billion US dollars in 2019. The country’s foreign liquid assets are just 5.4 billion US dollars.

All are worried with some justice that the projected negative growth for 2020 would further deteriorate the country’s economic situation particularly if the COVID-19 second wave cannot be stopped prior to 31 December 2020. Growth projections differ. Central Bank of Sri Lanka informed the economy would experience negative growth in 2020, but it would be -1.7 per cent. But the IMF and the World Bank came up with, probably more realistic figures that vary from 5 to 7 per cent. Consequently, many seem to think that negative growth would jeopardies other targets in the Vistas of Prosperity and Splendor presented by the President Gotabaya Rajapaksa that includes keeping inflation below 5 per cent, unemployment below 4 per cent and the Government lending rate below 9 per cent.

Positives in Negativity

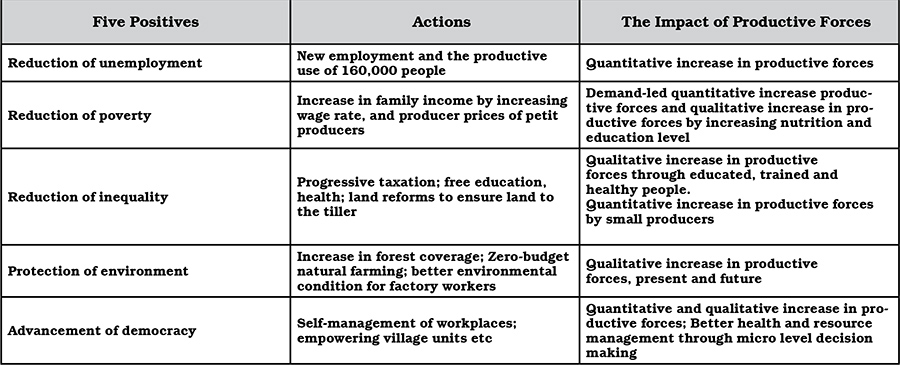

I wish to pose the issue from a different perspective. Instead of having 5 positives as a by-product of high rate of growth, couldn’t we give priority and preeminence to 5 positives and see what would eventually happen to economic growth although it is not the central element in the equation. Addressing directly five positives, the reduction of unemployment, inequality, and poverty, the conservation and improvement of ecology and the advancement of democracy would result in positive growth performance, not necessarily in quantitative terms, but essentially in qualitative terms as depicted in Figure 1.

Looking at the issue from a different aspect, the argument may be extended further. Some of the actions that would contribute to increase the GDP and the rate of growth may really have net negative impact. Let us take an example: the production of cigarettes. Cigarettes companies add value to the GDP in its conventional meaning. However, the medical experts have seen a very close association between smoking and cancers. So, the Government or private hospitals have to put their resources to treat cancer patients.

The payments for doctors and supporting staff are added into GDP. What does it mean? We add the cause of the disease as well as the treatment of the disease as positive value added to the GDP. But, no net real gain to the economy. The same may be cited with regard to fertiliser and pesticide used in agriculture. The argument is it contributes to agricultural production by rejuvenating soil fertility and destroying destructive insects. In appearance, the total amount of agricultural production will go up. So does the rate of growth. Nonetheless, the net result once again is negative since it results in kidney disease as the situation in the dry zone of Sri Lanka has witnessed. Once again, the treatment for kidney diseases is added to the GDP.

If both these cases are taken away from the national income account, the GDP will decline so the rate of growth becomes negative. So, is it naïve to argue that such negativity is in fact very positive as far as human welfare and environment are concerned?

Sumanasiri Liyanage

Europe Solidaire Sans Frontières

Europe Solidaire Sans Frontières

Twitter

Twitter Facebook

Facebook